CALS Travel Resources

Travel guidance for CALS employees.

Travel Resources

Travel Updates & REminders

All Travel News

Before, During and After the Trip

For NC State Employees

Before the Trip

When planning your trip the first item to address is obtaining authorization to travel. Please review the following information to gain a better understanding of what you need to do prior to making any travel arrangements.

Travel Authorization

Employees traveling on University business must have written prior approval from the department head (or their designee) before traveling and in order to qualify for reimbursement of overnight travel costs or meal costs when traveling overnight. Department Heads, or others that authorize travel, must have their travel authorized similarly by their supervisor or their designee.

Items that require specific written prior approval by the department head include:

- Overnight travel including lodging and meals

- Excess lodging rates

- Excess meals for out-of-country travel

- Business class fare for international overseas flights

- Vehicle rental

- Use of a private vehicle

- Attendants for handicapped employees

If adding personal travel to a business trip, the traveler needs to upload documentation as part of the Travel Authorization (TA) that proves the addition of the personal time does not increase the cost of the trip (e.g., flight without extra days vs. flight with extra days).

If choosing to drive versus fly or visa versa (if the location is close enough to drive), the Traveler needs to upload documentation of the cost analysis done to either cap their mileage (e.g., only request up to cost of airline ticket, including airline flights cost as back-up) or if you request more, show the cost analysis done to show driving is more economical (e.g., flight + car rental + parking fee at hotel) – again including the back-up to support those costs).

** REMEMBER**

For insurance/liability purposes, employees should have their travel authorized prior to traveling and always make sure that they can support their travel activities as being for official university business as authorized by the department even for day trips. It is recommended for verification purposes that employees document their communication of the travel plans and the business purpose of day trips with their supervisor or their designee prior to the trip by email, memo, letter, or other departmental forms.

Instructions for Creating a Travel Authorization (TA)

Before traveling please be sure to review the instructions and policies on the University Controller’s Office website, including how to obtain authorization, travel warnings, trip insurance, trip cancellation or changes, and more.

During the Trip

While traveling please be sure to collect receipts for any items you will be requesting reimbursement for. Here is some additional helpful information to keep in mind while traveling:

Transportation

- Commercial Airlines: Transportation by commercial airlines is limited to actual coach fares. Special charges by commercial airlines including baggage fees, seating accommodations within the coach class section, or airport service charges are allowable charges and may be paid/reimbursed as part of air transportation expenses.

- Employees traveling internationally on overseas flights may be reimbursed actual business class fare with prior approval of the department head or designee. (See Section 4.1.1 of the Travel Manual for detailed information).

- Ground Transportation: University travel shall be conducted in the most efficient manner and at the lowest and most reasonable cost to the university. With regard to passenger vehicle travel, whether in-state or out-of-state, university departments shall:

- Utilize university-owned vehicles

- Use of State term contracts for short-term rentals (State Term Contract 975B Vehicle Rental Service)

- Reimburse for use of personal vehicles on a limited basis in situations when the use of state-owned vehicles or state-term contract rental vehicles are not readily available

For additional information on different types of ground transportation please see Section 4.2 of the Travel Manual.

Lodging Expenses

To the extent possible, PCards should be used to pay for lodging costs. When using the PCard, the employee should ensure that only business expenses are charged to the PCard.

Please Note: Expenses such as food, laundry, movie, or game rentals charged to the room must be paid for personally and not charged to the university-issued PCard.

Subsistence Allowance Rates

Subsistence is an allowance for lodging and meal costs (including gratuities). To be eligible for allowances while in travel status, the employee must be acting in an official capacity as required by their work activities and the travel destination must be at least 35 miles from the employee’s duty station or home, whichever is less.

Detailed information on Subsistence Allowance Rates can be found in Section 3.0 of the Travel Manual.

Meal Expenses

Meal allowances are not allowed for travel unless overnight travel criteria are met. University employees when in overnight travel status are eligible to receive reimbursement for meals (including lunches) for full days of travel and for partial days (less than 24 hour period) when the partial day is the day of departure or the day of return and the partial day involves an overnight stay.

Tipping/Gratuity

Reimbursable gratuity or tips must be considered reasonable for items that are not already covered under subsistence. A reasonable tip would be one that a prudent person would give if traveling or conducting personal business and expending personal funds.

For further guidance, the following information is provided when calculating a tip:

- Airports

- Baggage Handling/Skycaps – no more than $2 per bag

- Shuttle Drivers – no more than $2 per bag.

- Parking/Auto Related

- Valets – $2 per car when collecting the car

- Taxi or car service drivers = no more than $5.00 per trip

- Lodging

- Housekeeping tips are not allowed

- Tips to a hotel employee for baggage handling or baggage checking should not exceed $2 per bag.

Detailed information can be found in Section 6.5 “Tips” of the Travel Manual.

Insurance

- Flight and/or travelers insurance including life and/or medical insurance is not reimbursable. (See Section 6.6 of the Travel Manual)

- Flight and/or travelers insurance may be purchased for out-of-country travel with non-state appropriated or grant funds if the grant specifically allows the expense.

- Business Traveler Insurance, including MedEvac/Repatriation coverage, may be purchased through Insurance & Risk Management for a fee.

For detailed information on Flight and/or Travelers Insurance please see Section 6.6 of the Travel Manual.

Fees & Service Charges

With sufficient justification and documentation and with the approval of the department head (or their designee), university employees can be reimbursed for usual, customary, and reasonable fees and service charges imposed by travel agents for assistance in making travel arrangements.

For additional information please see Section 6.0 of the Travel Manual).

For detailed information on Subsistence, Meal, Lodging, and Travel Expenses please see section 3.0 of the Travel Manual.

After the Trip

Transportation

- Commercial Airlines: Transportation by commercial airlines is limited to actual coach fare substantiated by a receipt. Special charges by commercial airlines including baggage fees, seating accommodations within the coach class section, or airport service charges are allowable charges and may be paid/reimbursed as part of air transportation expenses.

- Employees traveling internationally on overseas flights may be reimbursed actual business class fare (substantiated by receipt) with prior approval of the department head or designee. (See Section 4.1.1 of the Travel Manual for detailed information).

- Flight and/or travelers insurance including life and/or medical insurance is not reimbursable. (See Section 6.6 of the Travel Manual)

- Ground Transportation: University travel shall be conducted in the most efficient manner and at the lowest and most reasonable cost to the university. With regard to passenger vehicle travel, whether in-state or out-of-state, university departments shall:

- Maximize the utilization of university-owned vehicles

- Make use of State term contracts for short-term rentals (State Term Contract 975B Vehicle Rental Service)

- Reimburse for use of personal vehicles on a limited basis in situations when the use of state-owned vehicles or state-term contract rental vehicles are not readily available

For additional information on different types of ground transportation please see Section 4.2 of the Travel Manual.

Lodging Expenses

In order to qualify for reimbursement for overnight stays, the travel must involve a travel destination located at least 35 miles from the employee’s duty station or home, whichever is less, to the final travel destination.

Employee lodging expenses that are paid for or reimbursable by an entity outside NC State University may not be charged to the university.To the extent possible, PCards should be used to pay for lodging costs. When using the PCard, the employee should ensure that only business expenses are charged to the PCard.

- Reimbursement of lodging costs, whether in-state, out-of-state, or out-of-country, must be documented by an original receipt of actual lodging expenses from a commercial lodging establishment. The original receipt must provide evidence of:

- The claimant as the traveler

- The travel dates

- The room rate and taxes

- A final itemized billing of the lodging expenses incurred

- The name and address of the lodging establishment.

- Specific dates of lodging must be listed on the reimbursement request.

See 3.3-3.3.5 of the Travel Manual for detailed lodging reimbursement information.

Please Note: Expenses such as food, laundry, movie, or game rentals charged to the room must be paid for personally and not charged to the university-issued PCard.

Subsistence Allowance Rates

Subsistence is an allowance for lodging and meal costs (including gratuities). To be eligible for allowances while in travel status, the employee must be acting in an official capacity as required by their work activities and the travel destination must be at least 35 miles from the employee’s duty station or home, whichever is less. Ensure you are familiar with the calculations associated with the reimbursement of these expenses. The calculations must involve the starting address of the employee’s regularly assigned duty station or home, whichever is less, to the final travel destination.

Current Subsistence Rate Chart

Meal Expenses

Meal allowances are not allowed for travel unless overnight travel criteria are met. University employees when in overnight travel status are eligible to receive reimbursement for meals (including lunches) for full days of travel and for partial days (less than 24 hour period) when the partial day is the day of departure or the day of return and the partial day involves an overnight stay.

Tipping/Gratuity

- Reimbursable gratuity or tips must be considered reasonable for items that are not already covered under subsistence. Excessive tips will not be reimbursed. A reasonable tip would be one that a prudent person would give if traveling or conducting personal business and expending personal funds.

Detailed information can be found in Section 6.5 “Tips” of the Travel Manual.

Insurance

- Flight and/or travelers insurance including life and/or medical insurance is not reimbursable. (See Section 6.6 of the Travel Manual)

- Flight and/or travelers insurance may be purchased for out-of-country travel with non-state appropriated or grant funds if the grant specifically allows the expense.

For detailed information on Flight and/or Travelers Insurance please see Section 6.6 of the Travel Manual.

Fees & Services Charges

With sufficient justification and documentation and with the approval of the department head (or their designee), university employees can be reimbursed for usual, customary, and reasonable fees and service charges imposed by travel agents for assistance in making travel arrangements.

For additional information please see Section 6.0 of the Travel Manual).

For detailed information on Subsistence, Meal, Lodging, and Travel Expenses please see section 3.0 of the Travel Manual.

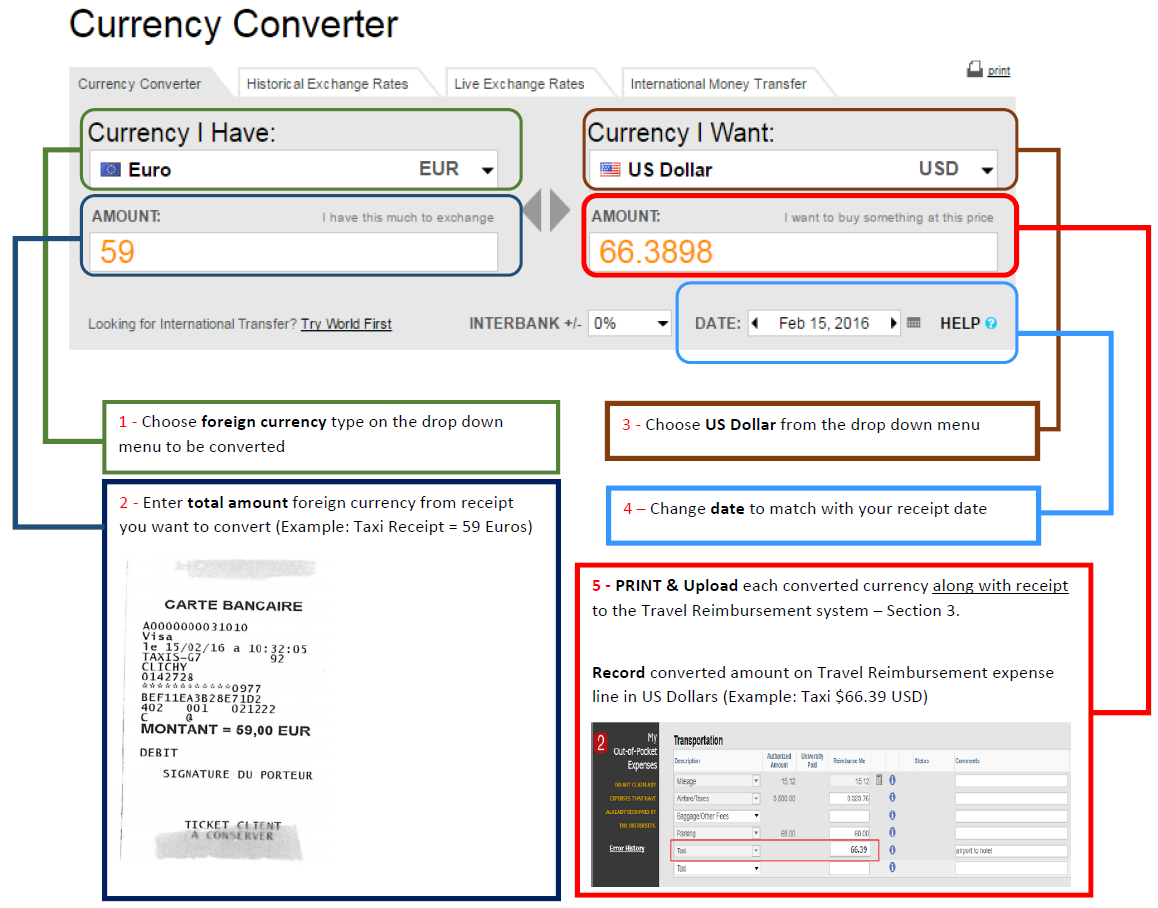

Foreign Currency Conversion

For international travel, you will need to convert foreign currency to US Dollars using currency conversion websites, such as Oanda. Foreign currency should be converted according to the currency exchange rate in effect at the time of travel.

After converting each expense, print or save the individual conversion. You must upload both the conversion sheet(s) and original receipt(s) into the travel reimbursement system. (Remember to exclude non-reimbursable and personal expenses prior to converting.)

Creating a Travel Reimbursement from a Travel Authorization

After completing your travel you will need to create and submit a Travel Reimbursement (TR) or any out-of-pocket expenses that qualify for reimbursement. For steps on creating a travel reimbursement from your travel authorization follow the steps inSection TC.1.4 of the Travel Manual.)

Creating a Travel Reimbursement for an employee without an Authorization

After completing your travel you will need to create and submit a Travel Reimbursement (TR) or any out-of-pocket expenses that qualify for reimbursement. To create a travel reimbursement for an employee who did not have a travel authorization follow the steps in Section TC.1.5 of the Travel Manual.

For Non-Employees and Students

Before the Trip

Please complete the AP104 Non-Employee Travel Authorization form and have approved by the Department Head. The approved AP104 will be submitted with the Travel Reimbursement request after your trip.

For first-time travelers, departments shall ensure a vendor number is available. A vendor number will be necessary to complete the AP 104 form. If no vendor number is available, please request a vendor number using the instructions provided in the Supplier Information Manual (for Campus) located on the Supplier Center website.

Non-Employee Travel

Travel by non-employees must be agreed to in advance by the traveler and the department head (or their designee) as to services to be provided by the traveler and the travel expense commitment made by the department.

Students and non-resident aliens must use the AP104 Form for travel authorization purposes.

Detailed information on Non-Employee and Student Authorization to Travel can be found by visiting section N.1.1 of the Travel Manual.

If adding personal travel to a business trip, the traveler needs to upload documentation as part of the AP104 Form that proves the addition of the personal time does not increase the cost of the trip (e.g., flight without extra days vs. flight with extra days).

If choosing to drive versus fly or visa versa (if the location is close enough to drive), the Traveler needs to upload documentation of the cost analysis done to either cap their mileage (e.g., only request up to cost of airline ticket, including airline flights cost as back-up) or if you request more, show the cost analysis done to show driving is more economical (e.g., flight + car rental + parking fee at hotel) – again including the back-up to support those costs).

Non-Resident Alien Travel

- Non-employee travelers that are non-resident aliens must use form AP104 to obtain travel authorization.

- The traveler must do the following:

- Disclose their visa status on form AP104 Form

- Obtain email confirmation from Kimberly Martin, the Controller’s Office Tax Specialist, at komartin@ncsu.edu regarding whether the University can pay travel expenses for the traveler and whether such payments are taxable.

- Departments must: ensure that this procedure is in place before authorizing travel and that the approved combined AP104 and AP105, the confirmation from the Tax Specialist.

Please see Section N.1.3 of the Travel Manual for the detailed instructions for authorization of Non-Resident Alien Travel.

Student Travel

- Student travel expenses, while working as an employee of the state, are considered on official state business when traveling on behalf of their position and shall be paid from the same source of funds from which the employee is paid.

- Approval for non-employee student travel to fulfill a course requirement for academic credit must have written prior approval from the Department Head. This is accomplished by completing form AP104 Form.

- The purchase of food or beverage for students at higher educational institutions is not allowable unless the student is in overnight travel status.

Detailed information on “ Student Travel” can be found in Section N.1.4 of the Travel Manual.

During the Trip

While traveling please be sure to collect receipts for any items you will be requesting reimbursement for. Here is some additional helpful information to keep in mind while traveling:

Transportation

- Commercial Airlines: Transportation by commercial airlines is limited to actual coach fares. Special charges by commercial airlines including baggage fees, seating accommodations within the coach class section, or airport service charges are allowable charges and may be paid/reimbursed as part of air transportation expenses.

- Employees traveling internationally on overseas flights may be reimbursed actual business class fare with prior approval of the department head or designee. (See Section 4.1.1 of the Travel Manual for detailed information).

- Ground Transportation: University travel shall be conducted in the most efficient manner and at the lowest and most reasonable cost to the university. With regard to passenger vehicle travel, whether in-state or out-of-state, university departments shall:

- Utilize university-owned vehicles

- Use of State term contracts for short-term rentals (State Term Contract 975B Vehicle Rental Service)

- Reimburse for use of personal vehicles on a limited basis in situations when the use of state-owned vehicles or state-term contract rental vehicles are not readily available

For additional information on different types of ground transportation please see Section 4.2 of the Travel Manual.

Lodging Expenses

To the extent possible, PCards should be used to pay for lodging costs. When using the PCard, the employee should ensure that only business expenses are charged to the PCard.

Please Note: Expenses such as food, laundry, movie, or game rentals charged to the room must be paid for personally and not charged to the university-issued PCard.

Subsistence Allowance Rates

Subsistence is an allowance for lodging and meal costs (including gratuities). To be eligible for allowances while in travel status, the employee must be acting in an official capacity as required by their work activities and the travel destination must be at least 35 miles from the employee’s duty station or home, whichever is less.

Detailed information on Subsistence Allowance Rates can be found in Section 3.0 of the Travel Manual.

Meal Expenses

Meal allowances are not allowed for travel unless overnight travel criteria are met. University employees when in overnight travel status are eligible to receive reimbursement for meals (including lunches) for full days of travel and for partial days (less than 24 hour period) when the partial day is the day of departure or the day of return and the partial day involves an overnight stay.

Tipping/Gratuity

Reimbursable gratuity or tips must be considered reasonable for items that are not already covered under subsistence. A reasonable tip would be one that a prudent person would give if traveling or conducting personal business and expending personal funds.

For further guidance, the following information is provided when calculating a tip:

- Airports

- Baggage Handling/Skycaps – no more than $2 per bag

- Shuttle Drivers – no more than $2 per bag.

- Parking/Auto Related

- Valets – $2 per car when collecting the car

- Taxi or car service drivers = no more than $5.00 per trip

- Lodging

- Housekeeping tips are not allowed

- Tips to a hotel employee for baggage handling or baggage checking should not exceed $2 per bag.

Detailed information can be found in Section 6.5 “Tips” of the Travel Manual.

Insurance

- Flight and/or travelers insurance including life and/or medical insurance is not reimbursable. (See Section 6.6 of the Travel Manual)

- Flight and/or travelers insurance may be purchased for out-of-country travel with non-state appropriated or grant funds if the grant specifically allows the expense.

- Business Traveler Insurance, including MedEvac/Repatriation coverage, may be purchased through Insurance & Risk Management for a fee.

For detailed information on Flight and/or Travelers Insurance please see Section 6.6 of the Travel Manual.

Fees & Service Charges

With sufficient justification and documentation and with the approval of the department head (or their designee), university employees can be reimbursed for usual, customary, and reasonable fees and service charges imposed by travel agents for assistance in making travel arrangements.

For additional information please see Section 6.0 of the Travel Manual).

For detailed information on Subsistence, Meal, Lodging, and Travel Expenses please see section 3.0 of the Travel Manual.

After the Trip

Non-employees traveling on University business whose expenses are paid or reimbursed by the University are subject to the same travel policies as are university employees, including statutory subsistence allowances.

The reimbursement request is made by using the Travel Center.

Please Note: Non-employees who come to North Carolina from out-of-state will be paid subsistence allowances at the in-state rate.

Creating a Travel Reimbursement for a non-employee without an Authorization

After completing your travel you will need to create and submit a Travel Reimbursement (TR) or any out-of-pocket expenses that qualify for reimbursement.

When a non-employee needs to submit a reimbursement please note that:

- The supervisor listed on the reimbursement will be the supervisor of the person that entered the reimbursement. The approving supervisor can be changed to fit business needs.

- Non-employees do not have access to the portal to certify their expenses. The person entering the reimbursement must certify the expenses for the non-employee.

More detailed information can be found in Section TC.1.5. Of the Travel Manual

To create a travel reimbursement for a non-employee without a travel authorization follow the steps in Section TC.1.5. Of the Travel Manual.

- Before you begin your Reimbursement request be sure to complete the CALS Business Operations AP 104- Non-Employee Travel Reimbursement Form and attach the approved AP104 form.

NON-EMPLOYEE Reimbursement

- Non-employees traveling on University business whose expenses are paid or reimbursed by the University are subject to the same travel policies as are university employees, including statutory subsistence allowances.

- The reimbursement request is made by using the Travel Center

Please Note: Travel expenses for members of a non-employee’s family are not eligible to be paid from state funds. Non-employees who come to North Carolina from out-of-state will be paid subsistence allowances at the in-state rate.

NON-RESIDENT ALIEN Reimbursement

- The traveler must do the following:

- Disclose their visa status on form AP104 Form

- Obtain email confirmation from Kimberly Martin, the Controller’s Office Tax Specialist, at komartin@ncsu.edu regarding whether the University can pay travel expenses for the traveler and whether such payments are taxable.

- Departments must:

- Attach the written confirmation from the Tax Specialist to the approved combined AP104 and AP105, when submitting the reimbursement claim to the Controller’s Office for payment.

- Ensure that this procedure is in place before authorizing travel

Please see Section N.1.3 of the Travel Manual for the detailed instructions for authorization of Non-Resident Alien Travel.

Student Reimbursement

Student travel expenses, while working as an employee of the state:

- Are considered on official state business when traveling on behalf of their position and shall be paid from the same source of funds from which the employee is paid.

Non-employee students at state institutions:

- Traveling on official state business are reimbursed from state funds consistent with payments for state employees.

Non-employee students who travel to fulfill a course requirement for academic credit:

- Non-employee students who travel to fulfill a course requirement for academic credit and whose expenses are paid or reimbursed from state funds are subject to these regulations, including statutory allowances, to the same extent as are state employees.

- Funds that are specifically appropriated or legally directed for student travel, or premium tuition or special fees deposited into state funds that include a student travel component may be used for student travel expenses.

Please Note: The purchase of food or beverage for students at higher educational institutions is not allowable unless the student is in overnight travel status. However, non-state funds may be used for these purposes if such funds have been established and authorized for such purposes.

Can’t Find What You Need?

International Travel: Currency Conversion

For international travel, you will need to convert foreign currency to US Dollars using the Oanda Currency Converter. After converting each expense, print or save the individual conversion. You must upload both the conversion sheet(s) and original receipt(s) into the travel reimbursement system. (Remember to exclude non-reimbursable and personal expenses prior to converting.)